Indonesian Motorcycles Industry 2025 start was shy. Following the rapid growth reported in the last years ended with a 2024 growth at 6.5 million, first quarter sales at 1.75 million (-1.8%) mainly due to March -5.7%.

Economic Outlook

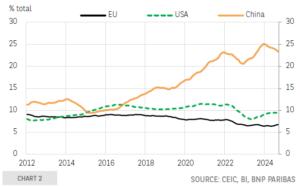

Economic prospects for the next three years are strong. Real GDP growth is expected to reach 5.1% on average, driven by the momentum of consumer spending and an increase in public investment. The main risks for 2025 concern changes in exports due to fragmentation of global trade, the economic slowdown in China (Indonesia’s main trading partner) and a potential increase in US tariffs.

In 2024, price increases slowed to 2.3% (vs. 3.7% in 2023). For 2025, a slight acceleration is expected due to the 1 percentage point (pp) increase in the VAT rate to 12% as of 1st January 2025. However, certain essential products are exempt. Consumer price inflation is expected to reach 2.8% by the end of 2025.

In trade terms, the Trump administration might increase tariffs on products coming from Indonesia. Although the US trade deficit with Indonesia is modest (“only” USD 18.2 billion in 2024) and incommensurate with its trade deficits with China and Vietnam (USD 293 billion and USD 122 billion, respectively), it has increased significantly over the past five years (+32.9%). In addition, Indonesia enjoys a preferential tariff trade policy, in particular for electronics, chemicals, furniture and rubber products. But these products only account for 1.4% of its exports to the United States.

Motorcycles Industry Trend and Perspectives

Indonesian motorcycles industry, the third largest in the world, is very relevant within the industrial system and represent by far, the largest individual mobility market, near sixth times largest than the car industry.

Following the rapid growth reported in the last years ended with a 2024 growth at 6.5 million, the 2025 start was shy, with first quarter sales at 1.75 million (-1.8%) mainly due to March -5.7%.

The EV segment keeps growing (+78.1%) thanks to the government incentives and several new start ups.

Electric Vehicles Segment Growth

In April 2024, the Indonesian government has committed U$455 million to subsidize the purchase of electric motorcycles aiming to cover the purchase of 800,000 new electric motorcycles and the conversion of 200,000 combustion engine motorcycles into electric ones. The subsidy program provides an Rp 7 million (roughly around US$435.36) discount on the purchase of electric motorcycles.

In 2024 the EV segment grew up 62.9%, but starting from a very low level, but hitting the 100.000 sales milestone for the first time.

During the year, the Chinese Giant and EV leader Yadea, announced a huge investment to produce electric scooter and motorcycles in Indonesia.

The inaugural vehicle delivery ceremony, held on March 14th, 2024, in Cikarang, Bekasi, Indonesia, marked a monumental milestone for Yadea’s expansion efforts in the Southeast Asian region.

Situated in Bekasi, West Java Province, the Yadea Indonesia production base encompasses a sprawling area of 28,000 square meters, boasting state-of-the-art facilities and cutting-edge technologies. With an impressive annual production capacity of 300,000 units.