French Motorcycles Market plummet. The start of 2025 was really harsh, mainly for the dealers need to sell out all the pre-registered vehicles in stock, and the market plummet hard ending the first quarter with 38.278 sales (-25.8%).

Economic Outlook

In 2025, the French economy is expected to continue to grow at a moderately low rate of around a quarter of a percentage point per quarter, or an annual average of 0.9%. Domestic demand is likely to be impacted not only by fiscal consolidation measures, but also by the uncertainty surrounding them.

As a result, household consumption is likely to grow only moderately, after posting sluggish growth in 2024. The contribution of private investment should remain negative, but much less so than in 2024. The contribution of foreign trade to growth should still be positive, but less than in 2024 due to a normalisation of imports after a period of marked decline.

Euro 5 Plus rules

With the Euro 5+ introduction, the limit values for motorcycles pollutants have been retained, but the difficult task of proving the durability of exhaust gas aftertreatment has been postponed from 2020 (Euro 5 introduction) until 2025, to the Euro 5+ standard, as it is now called.

At the same time, new regulations on noise measurement will apply from January 1, 2025, namely those in accordance with UNECE R41.05. The limit values do not change compared to the previously applied R41.04, but they must be achieved under significantly more operating conditions.

Motorcycles Industry Trend and Perspectives

While the whole European 2-wheeler market is running with a moderate sales increase (like Italy, the biggest one), the French motorcycle market keeps struggling and just the acceleration reported in November and December avoided to close 2024 in red. Only for this reason the total 2-Wheeler sales have been 282.734 (+1.8%).

The start of 2025 was really harsh, mainly for the dealers need to sell out all the pre-registered vehicles in stock and the market plummet hard ending the first quarter with 38.278 sales (-25.8%).

The performance is the same for scooter segment (-27.4%) and motorcycles (-23.2%) and even the electric segment is struggling (-28.1%).

Market Leaders and Performance

Looking at top manufacturer’s performance, Honda maintained its leading position losing less than the average (-15.7%).

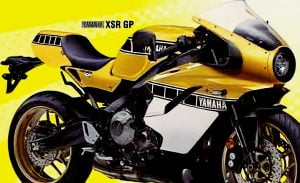

Yamaha experienced a deeper lost (-25.4%) while in third place BMW lost 18.7%.

Almost all players are losing in double-digit with KTM (-64.5%) and Husqvarna (-70.2%) among the worst.