European Electric Scooter & Motorcycles Market is ready to restart. During the third quarter the trend unchanged and the year to date September figures were 67.766 (-2.5%). Niu Tech is market leader, but Stark Future is the rising star.

Please note data reported regards the motorcycles industry in large extended, including not only 2/3 wheelers as moped, scooter, motorcycles, but even other vehicles, like ATVs, usually included in this industry. Differently from ACEA and other local sources (like FEBIAC), we do not consider the powered-bicycles inside the industry, even because data available regards only registered bicycles and are limited to those countries (Belgium, Netherlands, France) where a plate is required.

As you may have seen, reading our report on European Motorcycles Market, it seems that the momentum has not been lost by the industry in 2025, although the negative figures reported in the first half, due to the huge self-registered dealer stock at the start of the year.

Looking at the electric two wheeler segment, data aggregated for the entire region looks encouraging after a couple of years of decline, with 2024 ented with a lost of 5.0% from the previous year.

Indeed, the European EVs market was booming between 2017 and 2022 mainly driven by Chinese OEMs. But when in 2023 Niu Tech and others struggled to maintain volume and suddenly dropped down, losing the position gained within the distribution network, the market not only stopped the growth, but declined sharply.

In the first half of 2025 EVs sales in the 30 western countries were 44.037 (-2.1%). During the third quarter the trend unchanged and the year to date September figures were 67.766 (-2.5%)

The trend is different country by country: the largest market is France (-33.0%) and is encountering high difficulties due to the traffic limits imposed in Paris.

The second market is the Netherlands (+6.4%) and the third is the fastest growing Germany (+64.0%).

Behind, Italy (-16.4%), Spain (+30.1%), the United Kingdom (+33.2%),Belgium (-1.0%), Sweden (-40.9%), Austria (-11.4%) and Denmark (-1.6%).

Looking at the performance by manufacturers, the leader is Niu which is recovering fast (+38.7%), followed by Yadea (+20.7%).

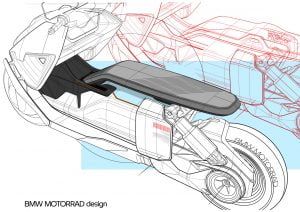

In third place VMoto (-13.5%) ahead of BMW (-32.2%), Talaria (+31.1%), Silence (+16.4%), Piaggio (-31.5%) and Stark Future (+6.581%%).