French Motorcycles Market is sharply declining in 2025. In the first half sales have been 117.652 sales (-19.4%), the worst performance among the largest EU countries. Honda is gaining market share, while KTM Group is collapsing.

Economic Outlook

After rising by 0.1% in the first quarter of 2025, GDP is expected to grow at a moderate pace in the first half of the year, before accelerating slightly in the second half of the year to an annual average of 0.6% in 2025 (after increasing by 1.1% in 2024).

In 2025, activity should be buoyed by domestic demand, while foreign trade will weigh negatively on growth. Growth is expected to strengthen to 1.0% in 2026, and to 1.2% in 2027, as consumption and private investment recover, followed by exports.

The outlook for consumer price inflation has been revised downwards. After 2.3% in 2024, headline inflation (HICP – Harmonised Index of Consumer Prices) is expected to flatline in 2025 at 1.0% due to a sharp decline in energy prices, while inflation excluding energy and food – including service prices – is expected to fall to 1.9%.

Motorcycles Industry Trend and Perspectives

While the whole European 2-wheeler market is running with a moderate sales increase (like Italy, the biggest one), the French motorcycle market keeps struggling and just the acceleration reported in November and December avoided to close 2024 in red. Only for this reason the total 2-Wheeler sales have been 282.734 (+1.8%).

However, the 2024 sales rush, due to euro 5 stage deadlines, left the market astonished and the first half of 2025 is reported as the worst in the last 2 decades.

Indeed, sales declined sharply in the first quarter (-25.8%), but even did not recover in the second (-14.5%) ending the first half with only 117.652 sales (-19.4%), the worst performance among the largest EU countries.

The performance is the same for scooter segment (-22.7%) and motorcycles (-20.1%) and even the electric segment is struggling (-18.3%).

The electric segment is losing 37.3% as well.

Market Leaders and Performance

Looking at top manufacturer’s performance, Honda maintained its leading position losing less than the average (-5.3%).

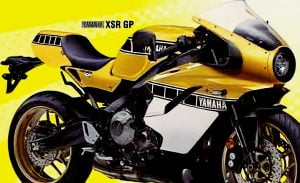

Yamaha experienced a deeper lost (-15.4%) while in third place BMW lost 15.7%.

Almost all players are losing in double-digit with KTM (-56.3%) and Husqvarna (-62.7%) among the worst.